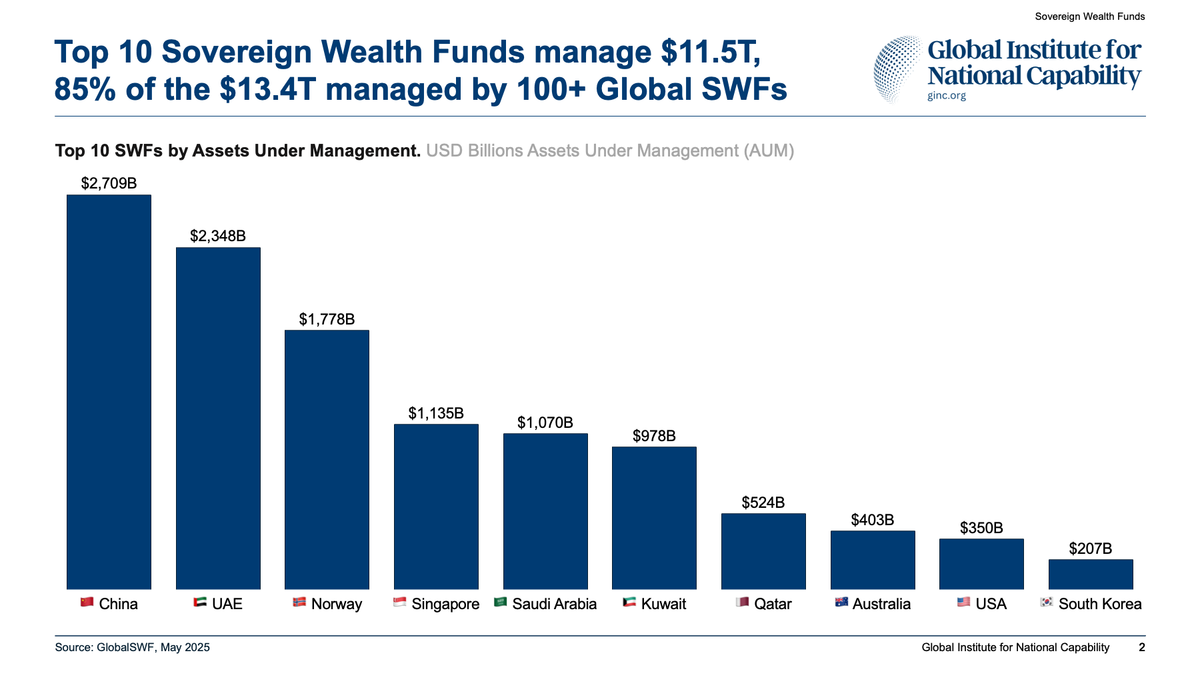

Top 10 Sovereign Wealth Funds

Top 10 Nations by Sovereign Wealth Fund Assets – Strategic Pillars of National Finance

Sovereign wealth funds (SWFs) have emerged as critical instruments of national financial resilience, long-term investment leverage, and even geopolitical influence. Global SWF assets have now surpassed $13 trillion , and the top 10 countries alone account for roughly $11–12 trillion of this capital. SWFs originated as vehicles for investing surplus revenues (from commodities or foreign exchange reserves) into global markets to generate returns. Today, their mandates extend further – from stabilizing budgets and saving for future generations to financing strategic development and bolstering global influence. Equipped with vast capital and long investment horizons, SWFs enable nations to weather economic volatility, invest in transformative industries, and project power through economic means.

🇨🇳 China

China’s sovereign wealth holdings (about $2.7 trillion in total) are the largest in the world . The country operates multiple SWFs, led by the SAFE Investment Company (~$1,357B) and the China Investment Corporation (CIC, $1,332B) . These two alone hold approximately $2.4 trillion in assets, playing a key role in financing China’s Belt and Road infrastructure projects and other strategic industries . Funded primarily by China’s immense foreign exchange reserves, they invest globally in equities, bonds, and real assets to earn returns and secure resources. Smaller funds like the China-Africa Development Fund ($10B) target development initiatives abroad, while others (e.g. HKIC ~$7B) serve niche strategic purposes. By leveraging SWFs, China not only diversifies its reserves but also extends its global economic influence – from stakes in ports and energy to technology ventures – aligning financial power with its geopolitical ambitions . These funds also bolster China’s financial resilience by converting trade surpluses into long-term investments.

🇦🇪 United Arab Emirates (UAE)

The United Arab Emirates commands roughly $2.3 trillion in SWF assets, split among several high-profile funds. The Abu Dhabi Investment Authority (ADIA) alone manages about $1.1 trillion , investing decades of oil surpluses into a globally diversified portfolio. ADIA’s mandate is long-term wealth preservation, and it has become one of the world’s largest institutional investors. Alongside, the Investment Corporation of Dubai (ICD, $380B) and Abu Dhabi’s Mubadala ($330B) and ADQ ($250B) funds focus on strategic development and diversification. Mubadala and ADQ, for instance, invest in building domestic industries (from energy to semiconductors) and have nurtured national champions (ADQ was instrumental in expanding Abu Dhabi’s TAQA utility) . Other UAE funds like the Emirates Investment Authority ($100B) and Dubai’s entities (e.g. Dubai Holding) round out the federation’s SWF network. This multi-fund approach allows the UAE to both safeguard wealth for the post-oil future and wield influence via marquee investments (from real estate to infrastructure) worldwide. The UAE’s SWFs thus underpin national financial strength and drive economic transformation at home, while also elevating its profile as a global investor.

🇳🇴 Norway

Norway’s sovereign wealth fund, managed by Norges Bank Investment Management, holds about $1.7–1.8 trillion in assets – the single largest SWF in the world. This Government Pension Fund Global (GPFG) was created from North Sea oil revenues to invest in international stocks, bonds, and real estate for the benefit of future generations . Uniquely, Norway’s fund cannot invest domestically; instead, it converts oil wealth into foreign investments to avoid overheating the local economy and to spread risk globally. Over decades, the GPFG has achieved broad diversification and now owns, on average, 1.5% of all listed equities worldwide . The fund’s strategic mandate is twofold: stabilize Norway’s economy (the government can spend a small, sustainable percentage of the fund each year – around 3% – to support the budget) and ensure long-term financial security when oil resources dwindle. By investing in sustainable and ethical assets, Norway also exerts soft power, pushing for corporate governance and climate-conscious practices. The Norwegian model exemplifies how a resource-based SWF can fortify national finances and serve as a “rainy day” reserve, having grown from modest beginnings to a cornerstone of the economy .

🇸🇬 Singapore

Singapore’s sovereign wealth posture, totaling about $1.13 trillion, is built on two major funds with distinct roles. GIC Private Limited (estimated ~$847B) manages Singapore’s foreign reserves, investing across global markets with a strictly long-term, risk-managed approach. Its goal is to preserve and enhance the purchasing power of Singapore’s reserves, serving as a bulwark against crises and a source of income for the government. Temasek Holdings (portfolio around $287B) operates more like a strategic investment company, holding equity stakes in key enterprises both domestically and abroad. Temasek’s focus has been on nurturing strategic industries – from banking and telecommunications to technology and biotech – aligning with national development priorities. Together, GIC and Temasek give Singapore outsized financial clout relative to its small size. They enable the city-state to tap global growth opportunities (e.g. investments in Silicon Valley, infrastructure in Asia) and to support home-grown companies’ global expansion. This twin-SWF model illustrates a shift in SWF strategy: beyond traditional reserve management, towards more active investment in innovation and development aligned with policy objectives . By leveraging these funds, Singapore has built a robust financial buffer and a platform for strategic economic influence in the region.

🇸🇦 Saudi Arabia

Saudi Arabia’s sovereign funds, with roughly $1.07 trillion combined, are central to its bid to diversify and modernize its oil-dependent economy. The Public Investment Fund (PIF) – about $925 billion in assets – has transformed in recent years from a passive holder of government stakes into a dynamic global investor . PIF is the engine of the Saudi Vision 2030 plan, funding mega-projects like NEOM city, the Red Sea tourism development, and Qiddiya entertainment city . It has aggressively taken international positions too (e.g. stakes in Uber, electric carmakers, and sports enterprises) to both earn returns and raise Saudi Arabia’s global profile. The National Development Fund (NDF) (~$132B) complements PIF by consolidating various domestic financing institutions to stimulate non-oil sectors and SMEs . Through NDF, Saudi Arabia channels capital into housing, industrial development, and infrastructure at home. Strategically, these SWFs are boosting Saudi financial resilience – raising debt when needed and attracting co-investment – while reducing reliance on volatile oil revenues. Saudi Arabia’s use of sovereign capital for both outward investment and internal development showcases the dual role of SWFs as tools for economic transformation and geopolitical strategy in the Gulf.

🇰🇼 Kuwait

Kuwait’s sovereign wealth is managed by the Kuwait Investment Authority (KIA), which oversees nearly $978 billion in assets . The KIA, established in 1953, is widely regarded as the world’s first and oldest sovereign wealth fund . It evolved from the Kuwait Investment Board set up to invest oil revenues long before Kuwait’s independence. The KIA comprises two primary funds: the General Reserve Fund (for short- to medium-term needs) and the Future Generations Fund, which receives a portion of oil revenues each year to save for the post-oil future. This structure was explicitly created to lessen the country’s dependence on oil by converting oil income into a diversified portfolio of international equities, bonds, real estate, private equity and more . Kuwait’s SWF has historically been a stability cushion – during crises like the Gulf War, KIA assets were vital for financing the government. By consistently investing surplus oil earnings abroad, the KIA has accumulated a massive buffer that underpins the Kuwaiti dinar and provides long-term fiscal security. Its strategic mandate is purely financial and conservative, yet the sheer size of Kuwait’s fund also grants it a voice in global investments (KIA is known for its significant stakes in companies and real estate worldwide). In summary, Kuwait’s SWF strategy reflects disciplined intergenerational saving and prudent global investment to ensure national resilience beyond oil.

🇶🇦 Qatar

Qatar’s Qatar Investment Authority (QIA) manages an estimated $524 billion in assets derived from the nation’s liquefied natural gas riches. Founded in 2005, QIA’s mission is to diversify Qatar’s wealth and reduce reliance on hydrocarbon revenues by investing in new asset classes and geographies . The fund predominantly invests internationally – in the U.S., Europe, and Asia – spanning sectors like finance, real estate, technology, and infrastructure. Notably, QIA has made headline-grabbing investments such as acquiring stakes in Barclays Bank, Volkswagen, London’s Shard skyscraper and Canary Wharf, and flagship projects like CityCenter in Washington D.C. These investments not only seek financial returns but have also elevated Qatar’s diplomatic and economic profile (soft power through assets). Domestically, QIA (via subsidiaries like Qatari Diar and Qatar Holding) has funded infrastructure and development projects, including those supporting Qatar’s hosting of the FIFA World Cup and its National Vision 2030 goals. By leveraging a relatively smaller but highly potent SWF, Qatar has been able to punch above its weight internationally – forging partnerships, attracting talent (through portfolio companies), and securing strategic footholds. QIA exemplifies how a focused SWF can transform natural resource wealth into a broad portfolio that will sustain national prosperity for decades and amplify the country’s global influence.

🇦🇺 Australia

Australia’s sovereign wealth assets, about $403 billion in total, are spread across several public funds with specialized mandates. The federal Future Fund ($204B) was established in 2006 to strengthen the government’s long-term financial position . It invested past budget surpluses and asset sale proceeds into a diversified portfolio (spanning global equities, debt, property, private equity, etc.), with the earnings intended to cover public service pension liabilities and other future obligations. This savings fund model has insulated Australia from some fiscal pressures by setting aside capital during boom years for use in leaner times. In addition, several Australian states run their own investment funds: for example, New South Wales’ TCorp ($75B) and Queensland’s QIC ($69B) manage state wealth, including proceeds from state asset transactions and public sector pension investments. Victoria’s VFMC ($52B) similarly invests on behalf of state government agencies and pension schemes. These funds collectively function akin to SWFs by investing public monies for the long haul. Their strategic role is mainly financial – securing higher returns to ease future budget burdens (like pension costs and infrastructure spending) and providing a stabilizing buffer for government finances. While Australia’s SWFs are modest next to oil-rich nations’, they reflect a proactive use of sovereign investments to bolster national capability, fund nation-building projects, and ensure intergenerational equity.

🇺🇸 United States

The United States has no national sovereign wealth fund, but several resource-rich states maintain their own funds which together hold around $350 billion. The most prominent is the Alaska Permanent Fund, approximately $80 billion in size, which was created in 1976 from oil revenues . Uniquely, the Alaska fund pays annual dividends to all residents, reflecting a model where citizens directly share in resource wealth – by law, roughly 50% of earnings are distributed as dividends . The Alaska Permanent Fund has also become a key source of budget earnings for the state, underscoring its role in supporting public services and future generations even as oil production declines. In Texas, two large endowments originated from oil and land income: the Permanent School Fund ($57B) and the Permanent University Fund ($37B) finance public schools and the University of Texas system, respectively. These funds, dating back to the 19th century, invest in diversified portfolios and provide steady educational funding streams . Similarly, states like New Mexico (State Investment Council funds ~$57B), Wyoming (Permanent Mineral Trust ~$30B), and North Dakota (Legacy Fund ~$11B) have trust funds that invest extraction tax revenues for long-term public benefit. While small by global standards, these sub-national SWFs help stabilize state finances and invest in local priorities. The idea of a U.S. federal SWF has periodically been floated to strategically invest in infrastructure or critical industries , highlighting recognition that sovereign-style investment could bolster national competitiveness. For now, America’s sovereign assets remain decentralized, but in each case, they serve as financial bulwarks and strategic investment tools at the state level.

🇰🇷 South Korea

South Korea’s sovereign wealth presence is anchored by the Korea Investment Corporation (KIC), which manages roughly $207 billion. Established in 2005, KIC was designed to invest a portion of the country’s ample foreign exchange reserves into higher-return assets worldwide . Rather than leaving all of South Korea’s reserves in low-yielding government bonds, the government and Bank of Korea entrust funds to KIC to be actively managed in global equity, fixed-income, private equity, and real estate markets. The mission is to enhance the nation’s long-term purchasing power and support the development of Korea’s financial industry through the experience gained abroad . KIC’s growth to over $200B in AUM by end-2024 (a record high) attests to its successful performance in recent years . Strategically, KIC operates as both a savings fund and an investment arm: it helps diversify the national wealth into international assets and serves as a sovereign investor that can partner with other global funds (for example, co-investing alongside Gulf SWFs or participating in overseas infrastructure deals). Although smaller than the mega-funds of larger economies, South Korea’s SWF contributes to national capability by boosting fiscal flexibility (through returns that augment the treasury) and by positioning Korea in global capital markets. It complements South Korea’s other pools of public capital (like pension funds) and signals the country’s status as a sophisticated economic player with a long-term vision.